You read our banner correctly. Hewitt Associates, the large human resources and outplacement firm, estimated in a 2005 study that nearly half of all job changers choose to cash in their

401(k) when they leave their jobs. One half of those who cashed in their 401(k) were unaware that they would incur substantial penalties if they did so. These penalties can easily wipe out fifty percent of the retirement nest egg you worked years to build up.

- 20% Withholding Tax. That’s right. If you withdraw $10,000 from your 401(k), you will only see $8,000 because your employer is obligated to withhold 20 percent.

- Tax on Ordinary Income (less what is withheld). That $10,000 is taxed as ordinary income, regardless of your cost basis. The highest bracket is 39.6 percent

(assuming the Bush tax cuts do not get renewed). Whack away another 19.6 percent, since the first 20% was withheld. - State Tax on Ordinary Income. If you are in an income tax state, they will ask for their cut, too. This adds up to as much as an extra six percent.

- 10% Early Withdrawal Penalty. The IRS will not care how tough your circumstances. If you withdraw before age 59 ½, you will owe another 10 percent off the top.

If you have a large lump sum, just the distribution itself could put you in the highest tax bracket. The total haircut is as high as 56 percent, depending on your federal tax bracket, your state tax bracket, and your age.

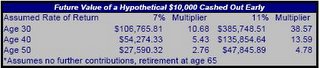

It gets worse. Consider that the money you withdrew can no longer be used to compound

tax free. Though it seems far off, this is the most damaging aspect of your loss. Consider the table below. Assuming you achieve 7 – 11 percent average annual returns (these are very

achievable rates, based on historical averages), you can see that, by cashing out, you are foregoing many times the amount of your withdrawal. That $10,000 withdrawal could pay for several years of your retirement. Use the “Multiplier” column to determine how much you would forego based on the lump sum in your plan right now.

You should take control of your retirement funds, but leave them in a qualified plan. Any reputable 401(k) administrator will make it easy for ex-employees to roll their retirement funds into an IRA Rollover account or the next employer’s qualified plan. Both actions will not incur any penalties.

At First Sustainable, we enourage customers to roll it into an IRA Rollover account. This gives the investor the maximum control by enabling you to have the widest array of investment choices to match your age, goals, and risk tolerance. We can help guide you through this process, and we invite you to have a free consultation with a Registered Investment Adviser. Call (800) 774-3319.

0 Comments:

Post a Comment

<< Home